EUR/JPY Price Analysis: Buyers will look for entry beyond 50% Fibonacci

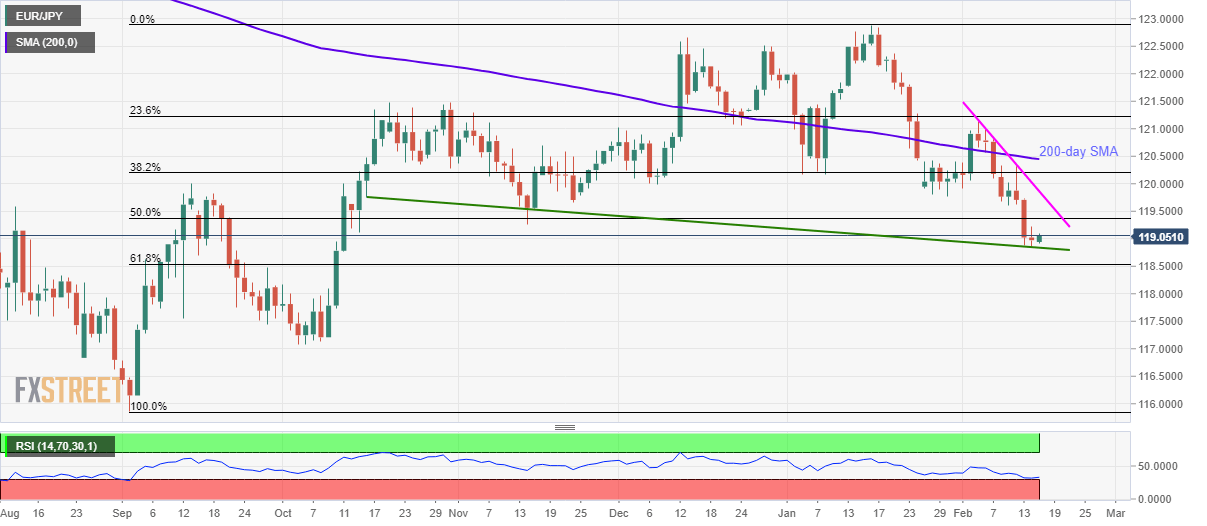

- EUR/JPY recently bounces off a four-month-old support line amid oversold RSI.

- An eight-day-old falling trend line, 200-day SMA restrict short-term upside.

- 61.8% of Fibonacci retracement offers additional support.

EUR/JPY registers modest gains of 0.06% while rising to 119.05 ahead of the European session on Monday. In doing so, the pair takes a U-turn from the four-month-old support line amid oversold RSI conditions. However, 50% Fibonacci retracement of its September 2019 to January 2020 upside still questions the immediate buyers.

In addition to 119.40 nearby resistance, a short-term descending trend line near 119.85 and 200-day SMA around 120.45 could keep challenging the bulls.

However, the pair’s sustained trading beyond 120.45 enables the buyers to challenge the monthly top surrounding 121.15.

On the downside, the aforementioned support line near 118.80 and the 61.8% Fibonacci retracement near 118.50 will act as the immediate rest-points during the fresh declines.

Should there be an additional weakness below 118.50, October month low near 117.00 could gain the sellers’ attention.

EUR/JPY daily chart

Trend: Bearish